$14,500 deductible!! -Are you crazy?

Nicholas Springer

What is your home insurance deductible? The average new deductible our agency starts with is $1,000. This means that $1,000 is taken of the top of the covered loss amount.

When a loss happens, the adjuster adds up all covered losses and then looks for the applicable deductible to subtract from the amount dispersed to the policy holder to indemnify them. The higher deductible you choose equates to a lower premium because you are taking on more of the risk yourself.

What some agents are doing to really lower rates can come as a shock when you least expect it.

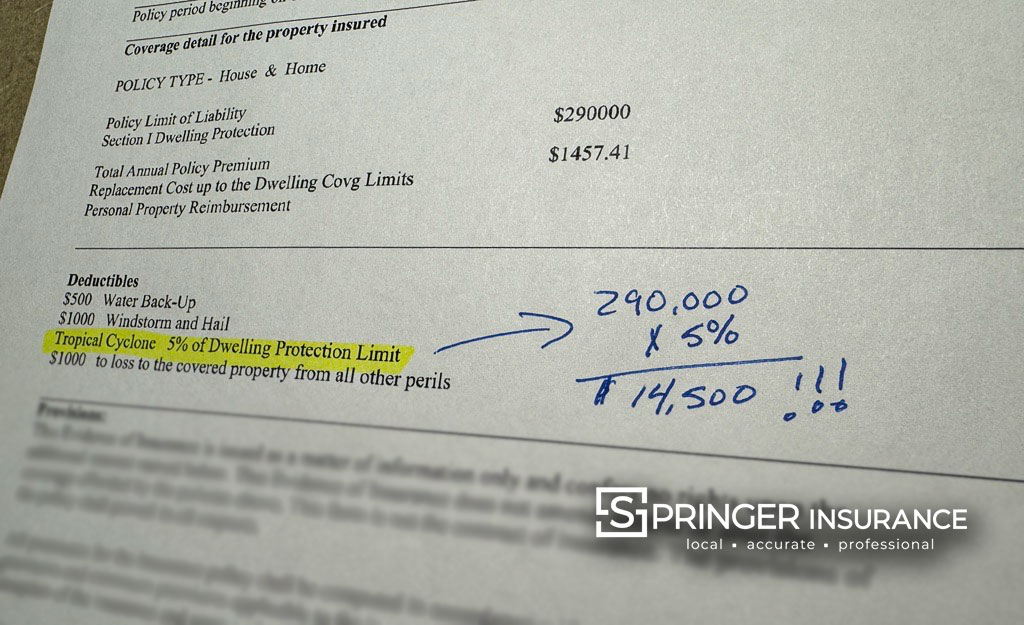

Percentage deductibles work a little different. Instead of the deductible being a whole, known number, it's actually a math equation involving the insured value of your home.

If your home is insured for $200,000, and you have a percentage deductible of 5%, this means that your deductible is 5% of the insured value of the home.

$200,000 X 5% = $10,000

$10,000 is way more than $1,000 and you may not even know you have it!

In our agency, we do our best to give you only one deductible. However, other agencies will give you one for Wind and Hail losses but charge a lower deductible for most other perils like fire, Theft and water damage etc.

$14,500

One of our clients recently went to another company and was shocked to learn that she got a lower rate because the new agent gave her a $14,500 deductible for tropical cyclone. She had her home insured for $290,000. 5% of $290,000 is exactly $14,000 more than the $500 deductible she had with her old policy. WOW.